In the fast-paced world of decentralized finance (DeFi), Hyperliquid Analytics has emerged as a game-changer. As the DeFi ecosystem continues to evolve, traders and investors need better tools to make informed decisions, manage risks, and maximize profits. That’s where Hyperliquid Analytics comes into play. This platform provides powerful insights into market trends, liquidity, and more, offering a competitive edge for those looking to thrive in the world of decentralized trading.

In this article, we’ll dive into what Hyperliquid Analytics is, how it works, and why it’s essential for the modern DeFi trader.

What is Hyperliquid Analytics?

Hyperliquid Analytics is an advanced analytics platform designed specifically for the DeFi market. By leveraging sophisticated data processing algorithms, it provides users with real-time insights into liquidity, price trends, order books, and other key trading indicators. Whether you’re a seasoned trader or a newcomer to DeFi, Hyperliquid Analytics can help you better understand market dynamics and improve your trading strategies.

Key Features of Hyperliquid Analytics:

- Real-Time Data: Hyperliquid Analytics offers up-to-the-minute data, enabling traders to make decisions based on the most current market conditions.

- Deep Liquidity Insights: The platform provides in-depth insights into liquidity, helping traders identify the best times to enter or exit trades.

- Advanced Charting Tools: With customizable charts and advanced indicators, users can analyze historical data and predict future market movements.

- Comprehensive Market Overview: Hyperliquid Analytics aggregates data from various decentralized exchanges (DEXs) and protocols, giving users a complete view of the DeFi market.

How Hyperliquid Analytics Enhances Trading Strategies

The DeFi market is notoriously volatile, and without the right tools, it can be challenging to navigate. Hyperliquid Analytics helps traders by providing detailed data and insights that support well-informed decisions. Here’s how it can enhance your trading strategies:

1. Identifying Market Trends

Hyperliquid Analytics is designed to analyze massive amounts of data, which allows it to identify emerging trends early. Whether it’s a shift in market sentiment or a new liquidity pool gaining traction, the platform’s advanced analytics can alert you to potential opportunities.

- Example: If there’s an increase in liquidity for a particular token, Hyperliquid Analytics can highlight this, helping traders identify assets with high potential for profit.

2. Improving Risk Management

Risk management is critical in any trading strategy, especially in volatile markets like DeFi. By tracking real-time data, Hyperliquid Analytics can provide insights that help users assess market risks and adjust their strategies accordingly.

- Example: If a particular trading pair is seeing significant slippage, the platform can alert you, allowing you to decide whether to adjust your position or avoid the trade altogether.

3. Enhancing Profitability

By providing detailed insights into price fluctuations, liquidity levels, and order book dynamics, Hyperliquid Analytics helps traders spot profitable opportunities. With this information, traders can time their entries and exits more accurately, maximizing their potential returns.

- Example: If there’s an unusual price movement in a particular DeFi token, Hyperliquid Analytics can provide the data needed to capitalize on the price swing.

Why Traders Love Hyperliquid Analytics

It’s not just the features that make Hyperliquid Analytics so appealing; it’s the tangible value it provides to users. Traders across the DeFi space rave about how the platform simplifies complex data and makes it actionable. Here’s why it’s so loved:

1. User-Friendly Interface

Despite its powerful capabilities, Hyperliquid Analytics has a clean, intuitive interface. Even users who are new to DeFi trading can navigate the platform with ease. With customizable dashboards and easy-to-read charts, traders can quickly find the information they need.

2. Customizable Alerts and Notifications

Another reason traders love Hyperliquid Analytics is the ability to set custom alerts. You can configure the platform to notify you of price movements, liquidity changes, or other market conditions that are important to your strategy. This ensures that you never miss a trading opportunity.

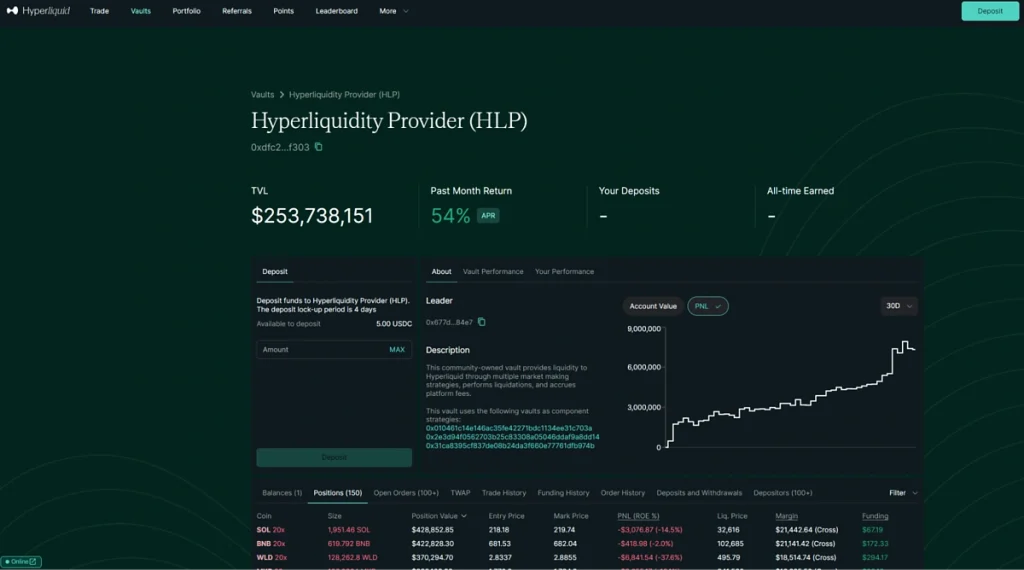

3. Comprehensive DeFi Market Data

Hyperliquid Analytics aggregates data from multiple DeFi platforms, giving users a holistic view of the market. Whether you’re tracking token prices, liquidity pools, or trading volumes, the platform brings all the essential data together in one place.

How to Get Started with Hyperliquid Analytics

If you’re ready to leverage Hyperliquid Analytics to enhance your trading, getting started is simple. The platform offers a straightforward sign-up process and a variety of subscription plans to suit different trading needs.

Steps to Get Started:

- Create an Account: Sign up on the Hyperliquid Analytics website and choose a subscription plan that works for you.

- Connect Your Wallet: Link your DeFi wallet to the platform to access real-time data and trading features.

- Set Up Alerts: Customize your alerts based on your trading preferences to stay updated on the latest market movements.

- Start Trading Smarter: Use the insights provided by Hyperliquid Analytics to optimize your trading strategies and improve your market predictions.

Conclusion: Stay Ahead with Hyperliquid Analytics

In today’s fast-moving DeFi landscape, staying ahead of the curve is essential. Hyperliquid Analytics provides the tools you need to understand market trends, manage risks, and ultimately, become a more successful trader. Whether you’re just starting out or looking to improve your existing strategies, this platform offers everything you need to thrive in the DeFi space.

Are you ready to take your trading to the next level? Explore Hyperliquid Analytics today and unlock the full potential of your trading strategy.